Article

Guiding Clients Through the Perfect Storm

BY: SHERRI SNELLING

CORPORATE GERONTOLOGIST

No Wall Street wizard, political pundit or historian could have predicted what Americans are experiencing right now. This pandemic period ushering in an economic recession has recently collided with coast to coast social protests and riots and what many believe will be the most polarizing presidential election in over 160 years. Some experts have deemed this to be the most disruptive, transformative period of U.S. history since World War II.

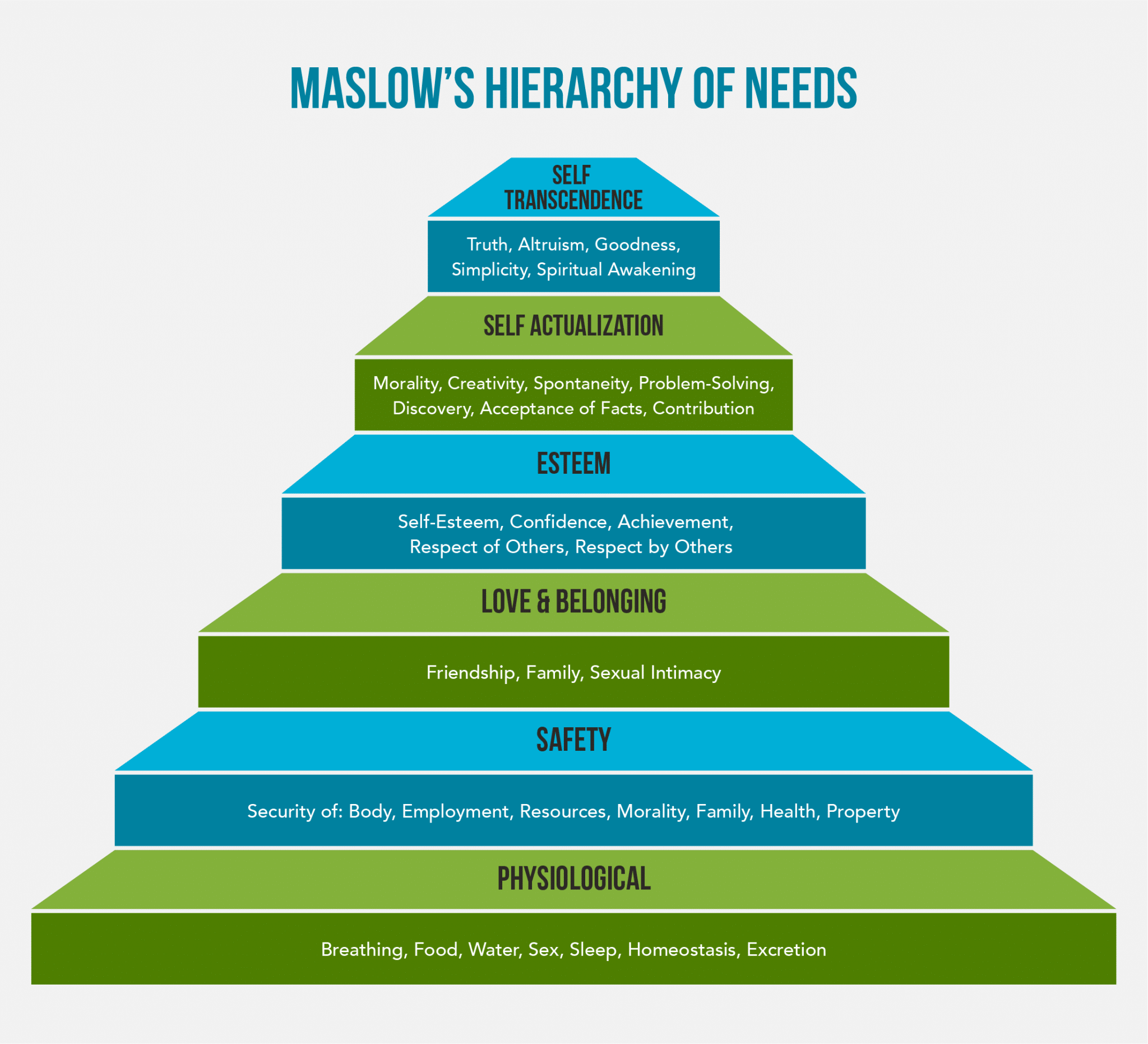

This era of uncertainty and upheaval creates an opportunity for financial advisors to reengage with clients on a more holistic level. To weather the storm, advisors can help clients plan not just for a solid financial future, but a better quality of life. It begins by going back to the basics of Abraham Maslow’s hierarchy of needs pyramid.

SHELTER FROM THE STORM

At the foundation of Maslow’s pyramid is shelter. But where and how we live may change as we emerge from the post-pandemic aftermath. A recent survey from AARP® showed a reverse housing trend is happening for those over age 65. Whereas almost 4 in 10 were looking to downsize their home to move closer to urban centers for entertainment and culture pre-COVID-19, now 53% are staying put.1 Part of this is the possibility of more generations living together under one roof which was on the rise prior to the pandemic. Kids are returning home from closed dorms at college, displaced workers from industries battered and capsized by the pandemic are seeking financial relief and moving in with older parents and many families want to live closer geographically or physically after experiencing enforced social distancing. Whatever the situation, most “home sweet home” plans have shifted.

Advisors will need to help clients through these decisions by focusing on three key areas.

- Proactively begin long-term care conversations with clients. Helping guide clients through the costs of senior living and long-term care, options for senior living or staying at home with more care as needed, and understanding the basics of what Medicare/Medicaid do and do not cover, make an advisor not just a trusted sounding board, but an informed and insightful guide for change. Read this article for some conversation techniques.

- Help clients with a livable home maintenance plan. Since most clients, at least for now, look to stay in their own homes, help them understand how to modify their homes for safety and comfort as they age. A report cited that between 1996–2016 there has been a 71% increase in households who have at least one member 80+ years old.2 To adapt, new home modifications should be made every ten years starting at age 50. There are great guides and checklists from numerous sources that will help advisors kick-start planning conversations to avoid what most gerontologists call “Peter Pan” housing — homes for those who will never grow old.

- Become knowledgeable about age-tech solutions. One of the fastest-growing areas of consumer technology is age-tech solutions. By 2030, $84 billion will be spent on tech solutions by those over age 50. Currently, 79% of purchases for older parents are made by family caregivers and women actually outspend men by 50% when it comes to technology in general, and especially age-tech for older parents or in-laws.3 Advances and investments by large tech companies including Microsoft, Amazon, Google, Facebook, Apple and others in wearables, voice first, GPS, artificial intelligence (AI), remote monitoring, robotics, virtual reality and more has created an exploding list of choices to stay safe and health-wise as we age.

The pessimist complains about the wind, the optimist expects it to change, the realist adjusts the sails.”

Adjusting the Sails for Financial Resiliency

Security is the second foundational level of Maslow’s pyramid. If there is one positive aspect of the global pandemic, it has put caregiving and long-term care at the center of financial planning for many families. A May 2020 survey showed that 7 in 10 Americans had changed their attitude about planning for long-term care (LTC) given the unforeseen health vulnerabilities of coronavirus. Three in 10 said they wanted to plan more effectively for their own long-term care as well as plan for costs of caregiving for older loved ones.4

Coupled with job insecurity, the number of workers over age 55 almost tripled from March to May and many companies are looking at older employees to anticipate or consider early retirement packages. Realities that reinforce an advisor’s role to help clients adjust their sails to become more financially resilient.

- Review long-term care costs with clients. Whether this is a new conversation or one that simply needs updating, now is the time to reach out to clients when this concern is top-of-mind for most families. Ensure the conversation includes not just a client’s personal long-term care plan, but also what their social support portfolio looks like – what do they anticipate in terms of helping parents, in-laws or other older loved ones with costs associated with caregiving.

- Weave in the Affective Forecasting model to create a happiness portfolio. While caregiving and long-term care have a sense of urgency, conversations around how to improve the quality of life for clients should be based on the Affective Forecasting model. Helping clients build a happiness portfolio every 10 years is what quality of life is all about and the value of this conversation is priceless. Read more about Affective Forecasting.

Finding a Safe Harbor

The next level of Maslow’s pyramid has to do with family, love and belonging. This is an area that has seen the most change since the beginning of the pandemic. While health concerns have been paramount, the flexibility of not commuting to an office and being present for the needs of both children and older parents has created a cocoon effect that some are loathe to give up. One survey conducted among 25,000 U.S. adults found 40% of employees felt employers should allow opt-in remote work from home (WFH) with 75% saying they would like this option occasionally and 54% stating they prefer WFH as their primary work mode.5

The profound changes that became part of everyday life during the pandemic will not just snap back into old norms. Advisors can help clients chart a course for their future by understanding all the significant changes that have happened over just a few short months. By guiding clients on life course decisions, an advisor earns the trust of clients and becomes a valued compass in navigating to calmer waters.

1 AARP (May, 2020), The Road Ahead: Key Trends & Challenges for Older Adults in the Age of COVID. Washington, D.C., AARP Research, May 2020.

2 Joint Center for Housing Studies at Harvard University (2019). Housing America’s older adults 2019. Boston, Mass.

3 Kakulla, Brittne Nelson. 2019 Tech Trends and the 50+. Washington, DC: AARP Research, January 2019. https://doi.org/10.26419/res.00269.001

4 Genworth Financial and J&K Solutions, LLC (May, 2020). Genworth’s COVID-19 Consumer Sentiment Survey. Richmond, VA, Genworth Financial, May 18-29, 2020. Retrieved from: prnewswire.com/news-releases/genworth-survey–covid-19-forces-americans-to-confronttheir-vulnerability-resolve-to-make-positive-changes-in-their-lives-301072142.html

5 The IBM Institute for Business Value (IBV), (April, 2020). Armonk, NY, April, 2020. Retrieved from: https://newsroom.ibm.com/2020-05-01-IBM-Study-COVID-19-Is-Significantly-Altering-U-S-Consumer-Behavior-and-Plans-Post-Crisis?mod=article_inline

This material was written by Sherri Snelling, MAG, Founder and CEO Caregiving Club. It has been prepared and distributed solely for information purposes. First Clearing has not verified the information and opinions in this report, nor does it make any representations as to their accuracy or completeness.

First Clearing is a trade name used by Wells Fargo Clearing Services, LLC, Member SIPC, a registered broker-dealer and non-bank affiliate of Wells Fargo & Company. ©2020 Wells Fargo Clearing Services, LLC. All rights reserved. First Clearing provides correspondent services to broker-dealers and registered investment advisors and does not provide services to the general public. CAR-0523-01178

For Broker-Dealer and Registered Investment Advisors use only. Not for use with the public.