Article

Happiness Plans for Clients: The Lessons of Getting Older and How Life Satisfaction is Part of Financial Planning

BY: SHERRI SNELLING

CORPORATE GERONTOLOGIST

For many, the recent COVID-19 global pandemic increased stress, anxiety and depression as routines were disrupted, families were isolated from each other and fears over an uncertain future affected everyone. In fact, a Kaiser Family Foundation (KFF) poll conducted in late March 2020 showed that 45 percent of U.S. adults reported negative mental health impact from the crisis.1

Interestingly, the same KFF survey found that older adults (over age 60) were less likely to feel stress and worry than younger generations and felt the pandemic had less negative impact on their emotional health (31% vs 49%) despite this older age group being most at risk and vulnerable to the virus. This same group is also more vulnerable to the economic fall-out of the pandemic with shorter timeframes to rebuild portfolios. Yet less stress prevails among older adults. Why?

This paradox offers revealing insights into the psychology of aging and how certain people can build resiliency to life’s challenges and disasters. Advisors who understand these theories can engage more effectively with clients of all generations to help them weather personal and public financial storms.

THE UPSIDE OF AGING

According to Erik Erikson, PhD, psychosocial development has eight stages between birth and death.2 The eighth stage is over age 65 where he theorized one can gain wisdom from a lifetime of experiences, both positive and negative. He described this stage as “the acceptance of one’s one and only life cycle as something that had to be” and “a sense of coherence and wholeness.” Erikson felt that by achieving wisdom and wholeness, or ego integrity, one loses the fear of death. He also saw this stage not as a decline but an era of personal growth and mastery. Think of the TV heroine Arya Stark who mastered her skills in Game of Thrones as she kept repeating her mentor’s mantra, “What do we say to the god of death? Not today.”

This idea of control also plays into Laura Carstensen’s, PhD, socioemotional selectivity theory (SST).3 Carstensen, who is the director of the Stanford Center on Longevity, highlights the ability of older adults to seek emotionally fulfilling, positive relationships and experiences rather than focusing on negative events or dissatisfying relationships as time horizons shrink. This gero-optimism (also called positivity theory) is also reflected in the theory of Swedish gerontologist, Lars Tornstam, who found that older adults have a decreased interest in superfluous social interaction and seek more moments of solitude rather than constant, yet meaningless, social activity. Social isolation and loneliness are issues aging services experts find concerning, but Tornstam advises that quiet and seclusion are not always a bad thing.

DEVELOPING RESILIENCY

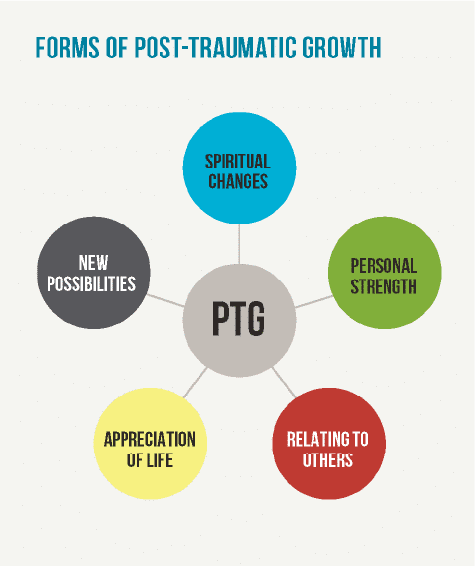

When it comes to facing adversity with resiliency, the psychological theory of post-traumatic growth (PTG) is especially relevant to advisor-client relationships. The five elements of the PTG theory are: gaining a new appreciation for life, creating new or more positive relationships, seeing new possibilities instead of focusing on loss, embracing a spiritual change and building personal strength through internal locus of control, which is one’s reaction to external factors. Numerous studies on older adults have shown that these are all typical trajectories for optimal aging that younger generations have not yet experienced and survived. In the same way wisdom is a cumulative effort, so too is resiliency. Sometimes we also have to put context around challenging events. One social media meme during COVID-19 captured it this way, “The Greatest Generation was asked to go to war, you are being asked to sit on the couch, eat pizza and binge watch Netflix. Trust me, you can do this.”

What advisors can do to help clients now and post-pandemic

Can the secrets of optimal aging play a role for advisors and clients? The reality is aging should not be viewed as a time of decline, disease and despair. Instead, it is an ever-ascending pyramid as presented by Abraham Maslow and his hierarchy of needs theory. Getting to the top is about self-transcendence. This level of altruism and peak experiences can be captured through affective forecasting that helps build a happiness plan for clients.

Affective forecasting is a theory by Dan Gilbert, psychology professor at Harvard University.4 Essentially, it is a model for looking at 10 years of life and re-evaluating goals and dreams every decade to continue to reach milestones that bring fulfillment and thus, happiness.

“Change is one of the only constants in our lives and amazingly human beings at any age constantly underestimate how much their personalities and their dreams change decade by decade well into later life,” said Gilbert during his 2014 TED Talk. “These personality changes bedevil decision-making in really important ways.”5

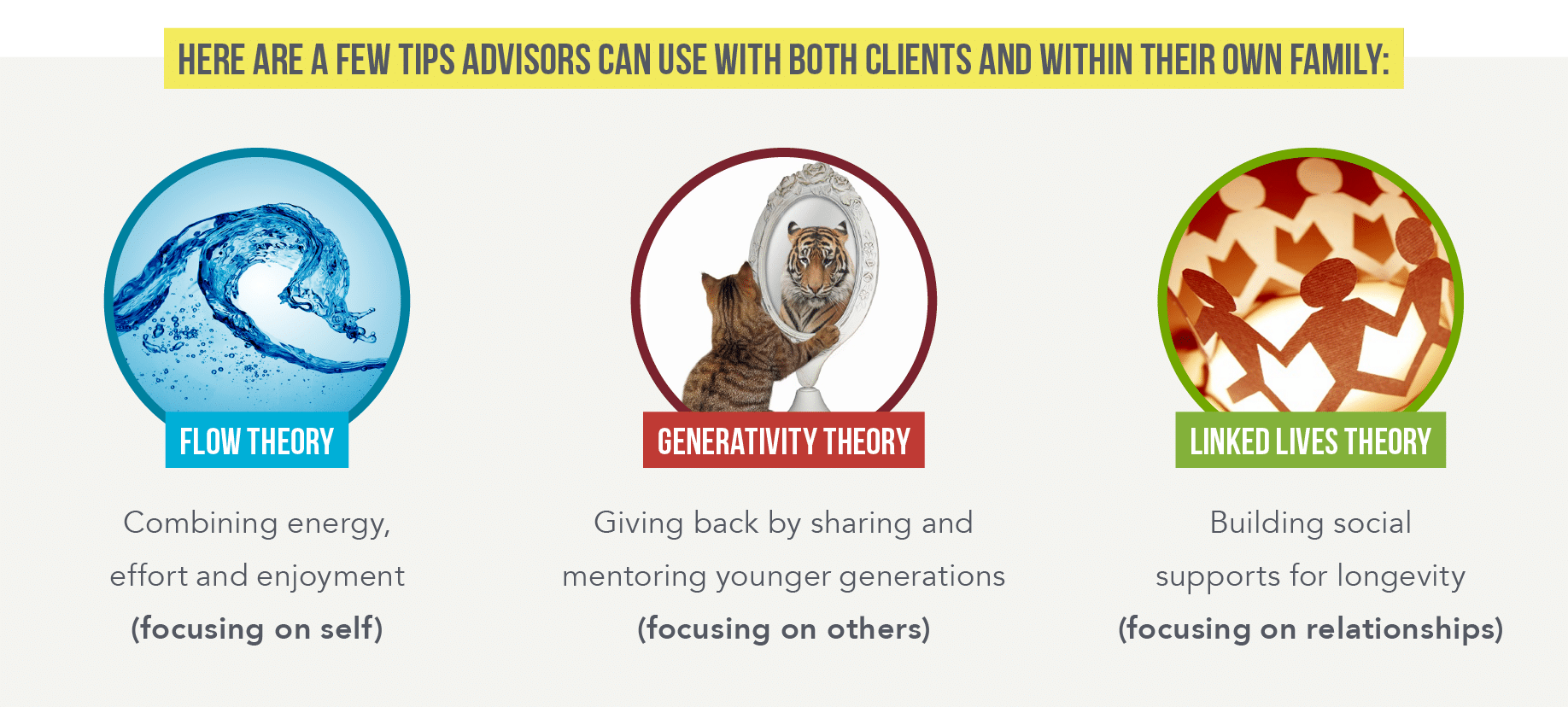

We hypothesize it may not be personality changes but rather aging insights that create resets every decade. And certainly, crisis events will shift client perspectives and values as well. To aid advisors we have curated three elements as part of our “Happiness Plans for Clients:”

Financial planning is about achieving happiness however that is defined by clients. As COVID-19 brought the prospect of death into our global consciousness, advisors can ‘flip the script.’ Consider using the book by Bronnie Ware, Top 5 Regrets of the Dying: A Life Transformed by the Dearly Departing 6, as a conversation starter for clients seeking happiness in a post-pandemic world:

- I wish I hadn’t worked so hard.

- I wish I had let myself be happier.

- I wish I had stayed in touch with my friends.

- I wish I had had the courage to express my feelings.

- I wish I had had the courage to live a life true to myself and not what others expected of me.

If advisors can help clients avoid these regrets later in life—that is the kind of value that is priceless.

Continued Reading

- Helping Clients Navigate Longevity: A BioPsychoSocial Model for Building Better Client Relationships

- Meet Gen C—Generation Caregiver: Insights into the Financial Wellness Risks of the Sandwich Generation Caring for Children and Older Parents

1 KFF Health Tracking Poll Early April, 2020 (conducted March 25-30, 2020). Henry J. Kaiser Foundation, San Francisco, Calif. Retrieved from: http://files.kff.org/attachment/Topline-KFF-Health-Tracking-Poll-Early-April-2020.pdf

2 Erikson E. H . (1982). The life cycle completed. New York: W.W. Norton & Company.

3 Carstensen, L. L., Fung, H. H., & Charles, S. T. (2003). Socioemotional selectivity theory and the regulation of emotion in the second half of life. Motivation and emotion, 27(2), 103 123.

4 Wilson, T. D., & Gilbert, D. T. (2005). Affective forecasting: Knowing what to want. Current directions in psychological science, 14(3), 131-134.

5 Gilbert, Dan. (2014). “The psychology of your future self.” TED2014. Retrieved from: https://www.ted.com/talks/dan_gilbert_the_psychology_of_your_future_self

6 Ware, B. (2012). The Top Five Regrets of the Dying: A Life Transformed by the Dearly Departing. United Kingdom: Hay House.

This material was written by Sherri Snelling, MAG, Founder and CEO Caregiving Club. It has been prepared and distributed solely for information purposes. First Clearing has not verified the information and opinions in this report, nor does it make any representations as to their accuracy or completeness.

First Clearing is a trade name used by Wells Fargo Clearing Services, LLC, Member SIPC, a registered broker-dealer and non-bank affiliate of Wells Fargo & Company. ©2023 Wells Fargo Clearing Services, LLC. All rights reserved. First Clearing provides correspondent services to broker-dealers and registered investment advisors and does not provide services to the general public. CAR-0423-01867

For Broker-Dealer and Registered Investment Advisors Use Only. Not for use with the public.