Article

Conversations Advisors Can’t Afford to Avoid with Clients and their Families

BY: SHERRI SNELLING

CORPORATE GERONTOLOGIST

When families get together the conversation is often about the grandkids, fantasy football, a great new restaurant or plans for marriage, babies, birthdays and anniversaries—in other words, the happy, joyful side of life. The same is probably true when an advisor sits down with a client to plan for those retirement dreams—trips to Paris or Africa, the vacation home in Montana or the boat in Florida, or the new kitchen remodel are more typical aspirational retirement planning conversations.

As advisors, engaging in long-term care and end-of-life conversations with clients can sound like crickets. No one wants to talk about getting older, more frail and needing help. As a society we avoid conversations about death at all costs. Yet with all the unknowns we face in life, getting older and dying are two guarantees we all have.

And that’s why these are exactly the conversations advisors should be having with their clients; because caregiving for older family members has the ability to bankrupt dreams and take a financial toll on families. Facing the $100,000+ a year sticker shock of dementia care for mom that could drain almost $1 million of your savings (on average those with Alzheimer’s will live nine or more years after diagnosis) or funding $7,500 a month for dad’s necessary cancer medication can erase joyful plans for the future.

Even though many clients may expect to help cover some care costs for older parents or in-laws, 66 million Americans are also caring for siblings who have no other means of support, friends who are widowed, divorced or never married and other family members such as aunts and uncles, grandparents and even cousins.1 While these financial situations all depend on family dynamics, an advisor who limits questions about the care needs of older parents may not cover a client’s entire future caregiving support picture.

The Bonus Years in Life: Both a Blessing and a Burden

The one thing most caregivers have in common is not understanding the costs of long-term care. Most are simply not prepared for the 20–30 bonus years of longevity and are especially not prepared for the cost of funding those years. The average life expectancy in 2019 in the U.S. was 78.87 years, up from 69.77 in 1960, and yet many are living into their 90s and 100s.2 These bonus years are not typically spent disease-free and healthy, but challenged with managing chronic illnesses, multiple medications, physical limitations or disability and cognitive decline.

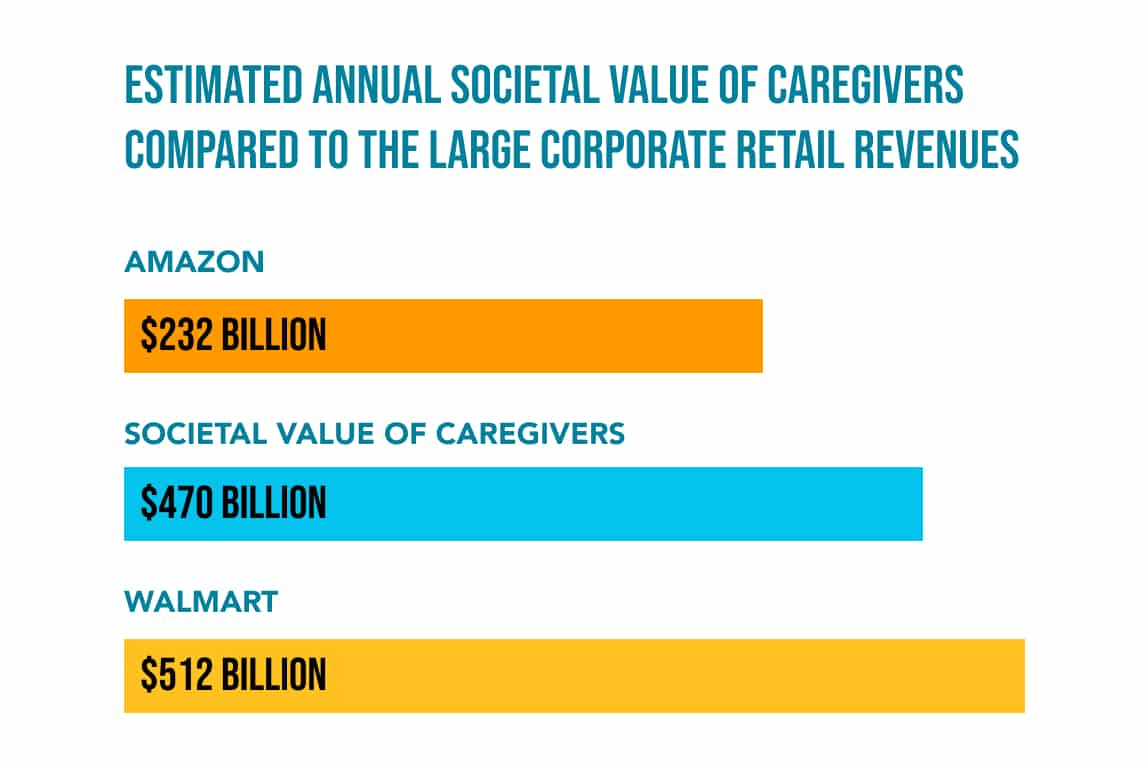

Many clients, and even advisors, erroneously think Medicare will cover all the costs needed to take care of later life’s long-term care needs. The reality is that while Medicare will cover a majority of medical costs for routine doctor visits and hospitalizations, it does not cover prescription drugs (without a special plan) and long-term care such as in-home care, assisted living or nursing home care. National studies show the average caregiver spends at least 20 percent of their annual income on these and other out-of-pocket care costs. And, this does not take into consideration the unpaid hours caregivers spend providing hands on care. In fact, the estimated annual societal value of caregivers is $470 billion a year—more than Amazon’s 2018 revenue ($232 billion) and almost equal to Walmart’s 2019 revenue ($512 billion).3

How to Have the Caregiving Conversation

All of this should be a wake-up call to advisors. But don’t expect a client (or family members) to start this conversation. There are a few simple rules that you as an advisor can follow to help with these discussions. And most importantly, these discussions should begin years before there is any hint of a crisis event before it’s too late to save, plan and prepare for the caregiving journey.

Here are a few tips advisors can use with both clients and within their own family:

- Start with a story. Rather than dive right into questions which can find clients reluctant, uncomfortable and uninformed, share a recent news report such as this Forbes Interview I did with Suze Orman, the financial guru, who was unsuccessful at getting her mom into a long-term care insurance plan and spent $25,000 a month on her mom’s care during the last few years of her life. Or maybe there was a recent TV show, movie or book with a caregiving situation. All of these are ways to ease into the conversation and have clients talk about their own wishes “if” this were to happen in their lives.

- Be an educated and empathetic expert. It’s important for advisors to be knowledgeable about aging issues and costs for things such as assisted living or home care. They also need to be empathetic to the stigma and sensitivities of certain diagnoses such as Alzheimer’s disease, mental health issues and even caregiver guilt that can keep clients from opening up. In addition, if a client has a parent they are not close to and therefore who may not feel financially obligated to provide support, think again. There are Filial Responsibility Laws in 30 states and Puerto Rico that require adult sons or daughters to cover unpaid medical and long-term care bills for biological parents and in some cases even for other relatives. While these laws were written in the 1700s, they are still on the books and therefore can be legally enforced by service providers who don’t want to be stuck with a hefty bill. In these situations, it is wise for an advisor to know an elder law attorney to whom you can refer a client.It is also important to cultivate relationships with both spouses and any adult children they may have. Statistics show that 70 percent of widows will change financial advisors three years after losing their husbands. In addition, the next 25 years will bring the biggest generational wealth transfer in our history with 45 million older adults passing $68 trillion to their children.4 By helping facilitate these caregiving conversations within families—perhaps holding an event or providing information to clients so that the whole family can engage in a conversation—your business will be about more than managing financial products—it will be about helping clients navigate unplanned caregiving costs.5

- Talk the talk, walk the walk. The best way for an advisor to be able to engage clients in the caregiving conversation is if the advisor has already helped manage these conversations in their own family. It will provide authenticity and anecdotes to share an advisor’s own experience about these family dialogues. It will also make advisors a trusted source for caregiving financial planning that also helps preserve a client’s future retirement dreams.

Continued Reading

Helping Clients Navigate Longevity

Meet Gen C— Generation Caregiver

1 National Alliance for Caregiving.. (2015). Caregiving in the US. AARP, Bethesda, MD: The National Alliance for Caregiving.

2 https://www.macrotrends.net/countries/USA/united-states/life-expectancy

3 Reinhard, S.C., Feinberg, L.F., Choula, R., & Houser, A. (2015). “Valuing the invaluable: 2015 Update.” Insight on the Issues, 104, 89-98.

4 Harris Interactive Poll Online Panel, (2014). (n 58) 6

5 Robinson, D., contributor, (February 25, 2019) “The great wealth transfer” segment, CNBC, NBCUniversal, Englewood Cliffs, New Jersey.

This material was written by Sherri Snelling, MAG, Founder and CEO Caregiving Club. It has been prepared and distributed solely for information purposes. First Clearing has not verified the information and opinions in this report, nor does it make any representations as to their accuracy or completeness.

![]()

First Clearing is a trade name used by Wells Fargo Clearing Services, LLC, Member SIPC, a registered broker-dealer and non-bank affiliate of Wells Fargo & Company. ©2023 Wells Fargo Clearing Services, LLC. All rights reserved. First Clearing provides correspondent services to broker-dealers and does not provide services to the general public. CAR 0223-01070